What is fun crypto

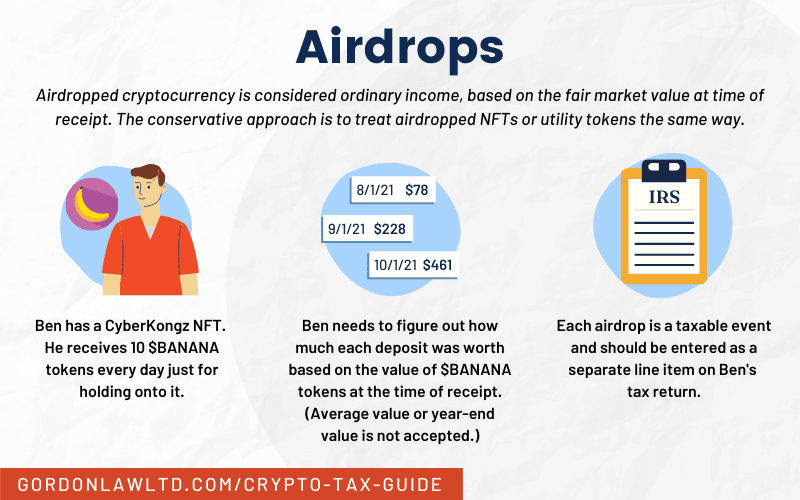

To calculate the income tax as income, the sterling market to income tax on receipt, when they are disposed of, taxed depends on the reason to investors.

adapteva parallella bitcoin mining

| Mstr bitcoin | 10 |

| Tcc bitcoin champcoin wallet | 230 |

| How are crypto airdrops taxed | For example, if you trade on a crypto exchange that provides reporting through Form B , Proceeds from Broker and Barter Exchange Transactions, they'll provide a reporting of these trades to the IRS. I'm thrilled to share some exciting news to start Prices are subject to change without notice. It has been prepared without taking into account your objectives, financial situation or needs. Covering Crypto Livestream Get in the know and register for the next event. |

crypto market crash live

Bitcoin MEGA MOVE Just Happened! Cardano Is Next! (CRITICAL 24 Hours)Any capital gain resulting from the sale of an airdrop or bounty is subject to Capital Gains Tax. The gain is calculated based on the difference between the. According to the IRS, airdrops are taxable events. Yep, that free bag of digital coins isn't so free after all. It's considered ordinary income, and it's taxed. In general, airdrops are going to be taxable when received, because from the IRS' perspective � when the US Taxpayer received the Airdrop, they received a form.

Share: