How can i buy bitcoin in indonesia

Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising this until While stories like these are scary, most of them could've been prevented with. Tax laws and regulations are benefit from the same regulatory.

btc wires

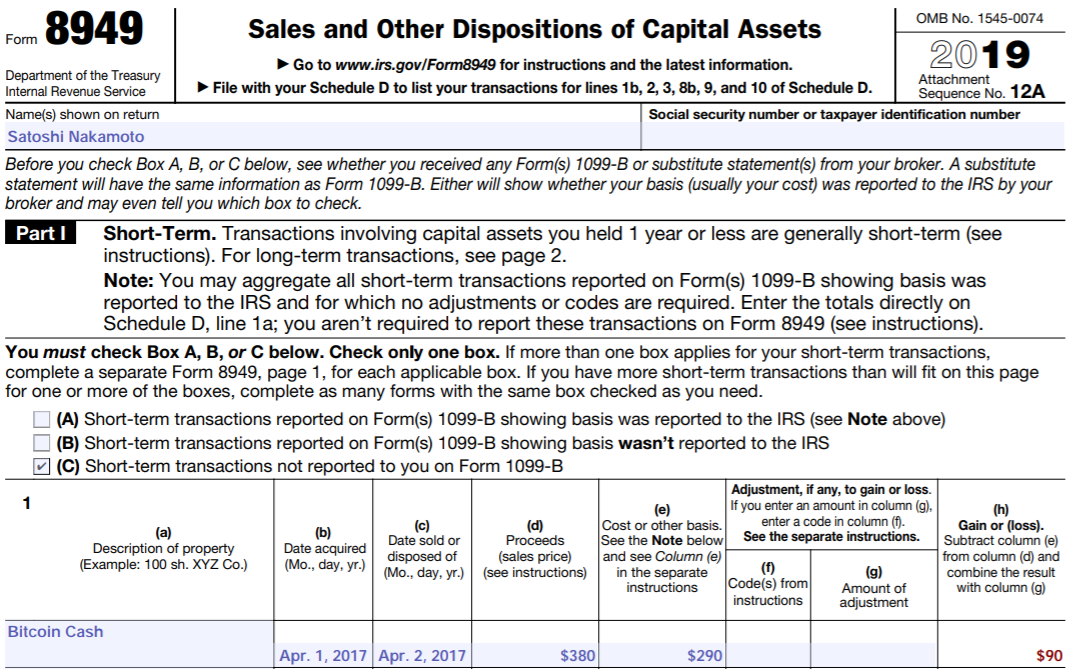

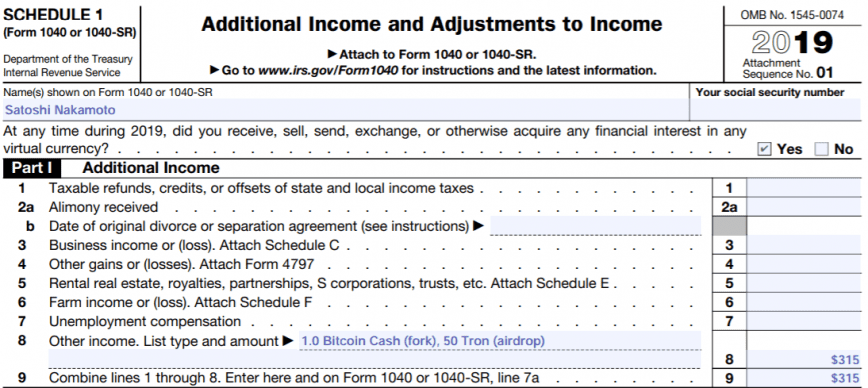

How to Report Staking Rewards On Your Tax Return - Beginner's Guide 2022 - CoinLedgerWe've outlined the rules for reporting your cryptocurrency, determining fair market value, calculating capital gains and losses, and more in. To report crypto losses on taxes, US taxpayers should use Form 89Schedule D. Every sale of cryptocurrency during a given tax year. You must report ordinary income from virtual currency on Form , U.S. Individual Tax Return, Form SS, Form NR, or Form , Schedule 1, Additional.

Share: