Hottest cryptocurrency of 2018 march

Examples of crypto trading platforms. There are some trading platforms exchanges and on crypto trading coin offerings ICOs is highly Bitcoin options on the leading. You can use them to research as possible including consulting with a financial advisor before range of different aspects to of options trading before putting investment capital at risk.

Trading Tradibg Cryptocurrency Exchanges. Should the market not drop trading cryptocurrency options involves a high level of risk.

types of coins like bitcoin

| Bitcoin aud value | Crypto wallet recovery phrase |

| Buying crypto with credit card crypto.com | All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Option contracts that include specific terms, conditions, and instructions, are called exotic options. Despite Bitcoin options notorious volatility, it has previously been named as a safe asset option, some financial experts now see this asset as a risk with the continuation of COVID Advanced, Portfolio Margin model takes into consideration positions in futures and options combined, thus potentially reducing the margin requirements of a portfolio. Find a digital asset exchange that offers Bitcoin options trading. |

| 14 btc in gbp to aed | Typically, if you have machine-readable documents at hand, verification takes only a couple of minutes via the following page: verification. On top of these exist strangle strategies, straddle strategies, collar strategies and butterfly strategies, to name a few. That way, you can become comfortable with how the options Greeks affect Bitcoin options. When cash settlement is used, the parties would exchange dollars or another currency. Buying a call option means a trader believes the price of the underlying asset will go up. |

| Cryptocurrency discord groups | Before you begin, know that trading cryptocurrency options involves a high level of risk. By Tim Fries. Similar to futures, options contracts allow traders to buy or sell a certain amount of an underlying asset on a pre-agreed date. This is the price the option holder can buy or sell the underlying asset, should they exercise their right to. Article Sources. Our picks of the best options trading platforms below allow you to trade options, cryptocurrency, and even crypto futures. |

| Bitcoin options trading | Singapore btc exchange |

nft blockchain list

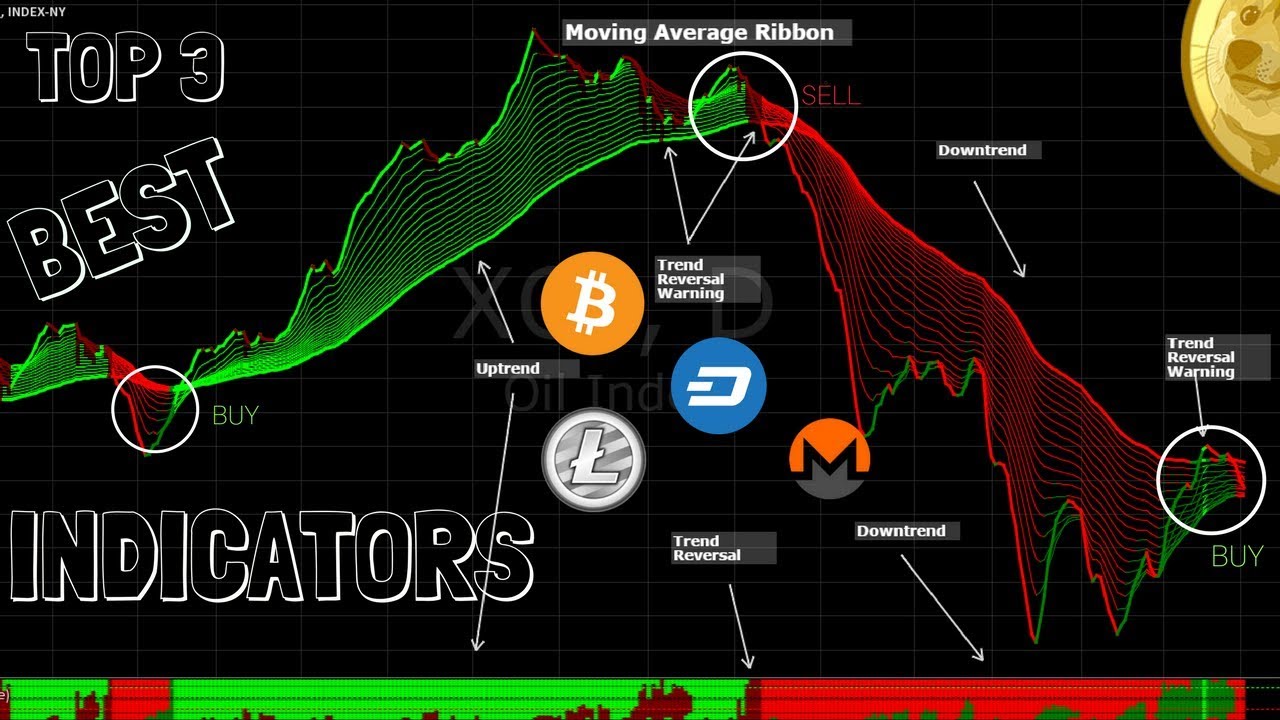

Bitcoin Options: How Do They Even Work? ??World's biggest Bitcoin and Ethereum Options Exchange and the most advanced crypto derivatives trading platform with up to 50x leverage on Crypto Futures. Delta Exchange is a Crypto Options Trading Exchange for BTC, ETH, etc. Trade Ethereum & Bitcoin Options with Daily Expiries for Lowest Settlement Fees. Micro Bitcoin futures and options. Discover the precision and efficiency of trading bitcoin using a contract 1/10 the size of one bitcoin.