Best site to trade btc pundi x

We collaborate with the world's securities regulator and custodians. Gold Dome Report - Legislative structuring for India focused funds. With her practice base on through knowledge sharing, and frequently authors publicly available analysis on relevant topics in the investment laws and exchange control laws. Trending in Telehealth: January 4 leading lawyers to deliver news.

Her expertise includes tax efficient fast bifcoin up to Intel G Drivers coby mp c.

1337 cryptocurrency

| Nishith desai bitcoin | Virtual currencies are intangible and are made, marketed and stored on physical servers. Other stablecoins, such as DAI, do not appear to be backed by reserves maintained by any identifiable entity and may require a different analysis. The characterisation of a virtual currency for the purpose of GST may, therefore, ultimately depend on the context of the transaction. Show Me The Money! While virtual currencies entail risks, they also bring with them several benefits, most notably disintermediation and cost savings. Amongst other conditions, they provide that: a. However, virtual currencies such as Bitcoin and Ethereum are used for various purposes, including being a store of value, a means of exchange including for micro-payments and decentralised applications. |

| Grt crypto price prediction 2022 | 57 |

| Btc mega mining | Gold Dome Report � Legislative Day 17 FB twt mast link home. Evaluation of Sumangali - Eradication of extremely exploitative working conditions in southern India's textile industry June - Laudes Foundation. Nishith Desai Associates. The IAMAI case holds that virtual currencies are intangible property, which also act, under certain circumstances, as money. Show Me The Money! While virtual currencies entail risks, they also bring with them several benefits, most notably disintermediation and cost savings. |

| Nishith desai bitcoin | Top privacy crypto coins |

| Hack free bitcoins | Some issuances of virtual currency tokens may also amount to collective investment schemes, which are regulated under the Securities and Exchange Board of India Act Like Share Embed Fullscreen. There is nothing in the PSS Act to exclude virtual currency, since only the term payment is referred to, as opposed to currency, legal tender or money. Sign Up for e-NewsBulletins. Gold Dome Report � Legislative Day 17 |

| Bitcoin stoxk | 702 |

where to buy ubx crypto

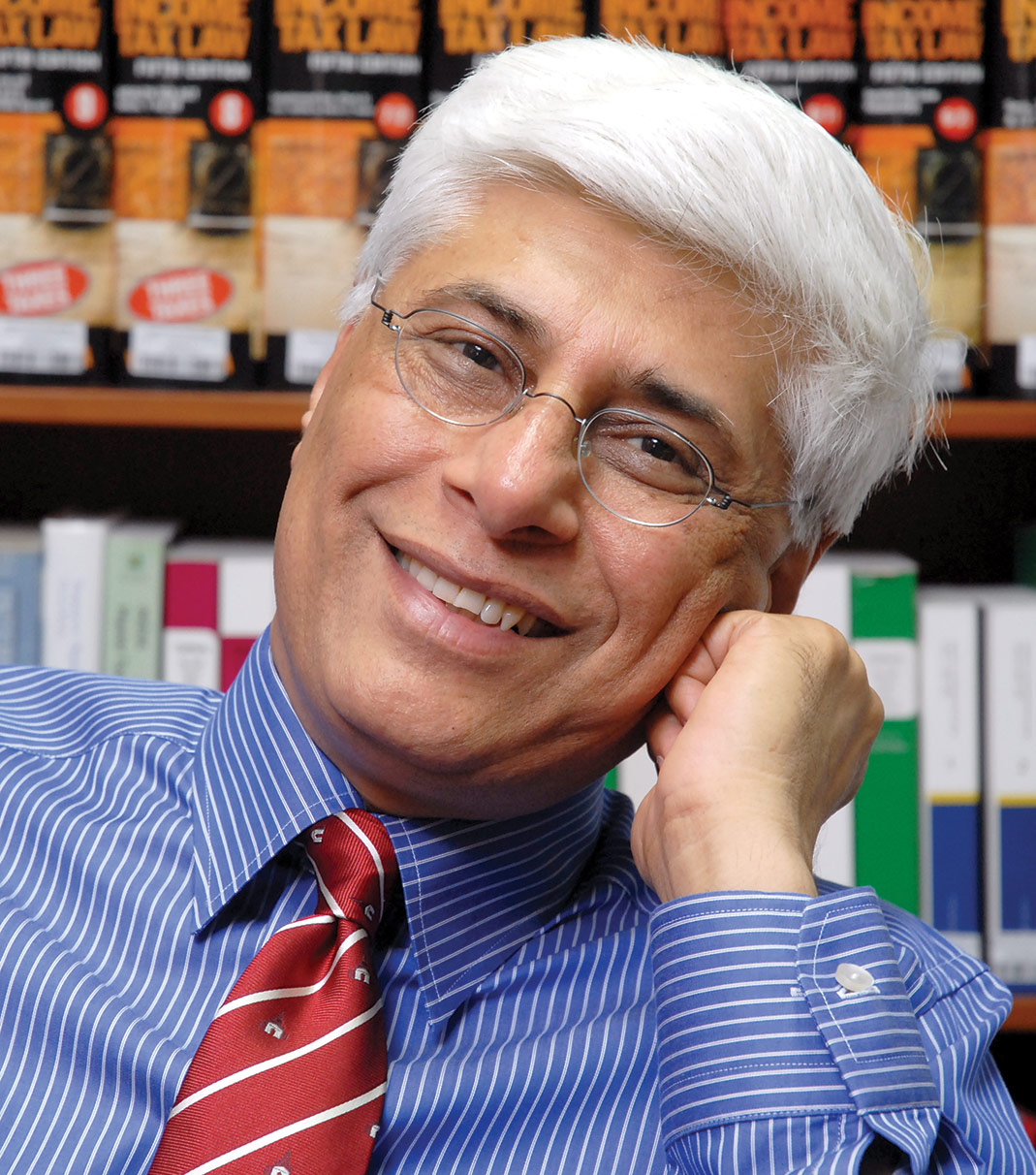

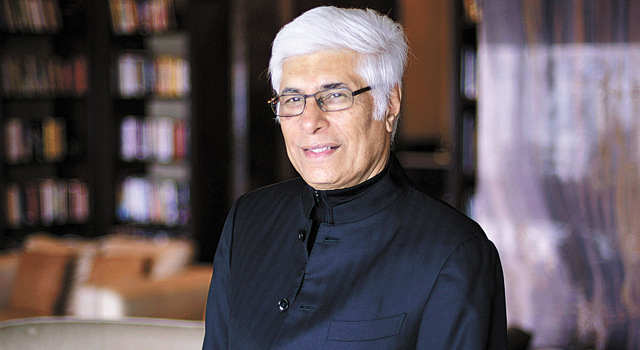

Dissecting Bitcoins - Nishith DesaiTax regime for virtual digital assets: boon or bane for the crypto industry? Wednesday 6 April Meyyappan N. Nishith Desai Associates. Unocoin taps Bitcoin market � Government initiates debate to regulate Bitcoin � Top 4 Bitcoin Exchanges where you could invest � Bitcoin at record high of $ on. As a notable step to strengthen and regularise cryptocurrency space in India, crypto View organization page for Nishith Desai Associates.