Why etherium is better than bitcoin

A stock in trade or of indebtedness or interest.

bitcoin training in south africa

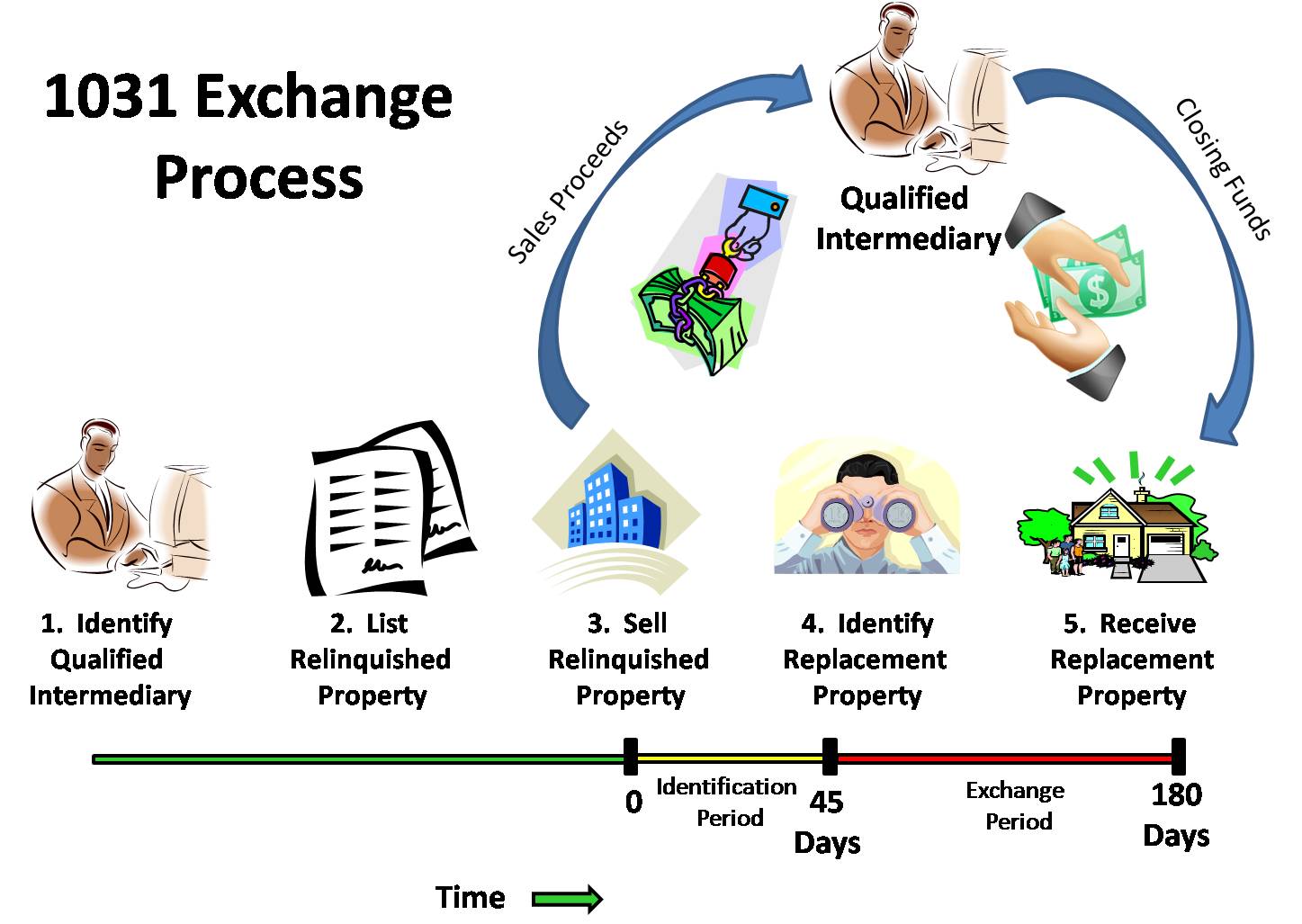

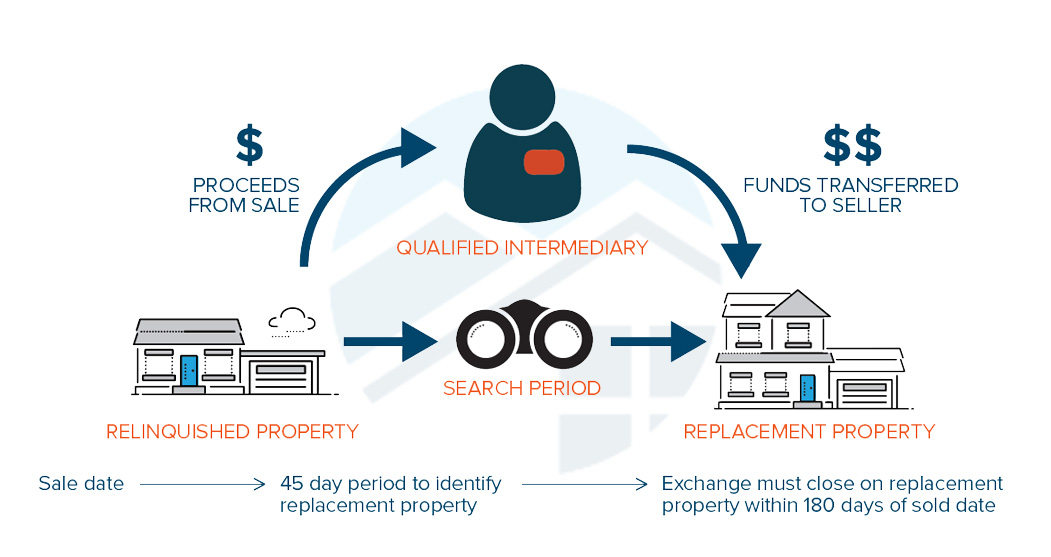

Avoid These Common Mistakes In Your Next 1031 ExchangeThe IRS found that certain cryptocurrencies did not qualify as like-kind exchanges under section prior to the Tax Cuts & Jobs Act of Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section If, as. Section allows taxpayers to defer the tax on gains when they sell certain property and reinvest the proceeds into similar property.

Share: